Handling tax exempt customers

Some customers, like wholesalers and nonprofit organisations, can be exempt from taxes. You can mark such buyers as non-taxable, so that they could check out in your store without taxes applied to their orders. For instructions on setting up taxes in your store, please refer to this article: Taxes

How to mark customers as tax exempt

In order to exempt a customer from paying taxes in your store, you should mark them as non-taxable in your store’s admin by following the steps below:

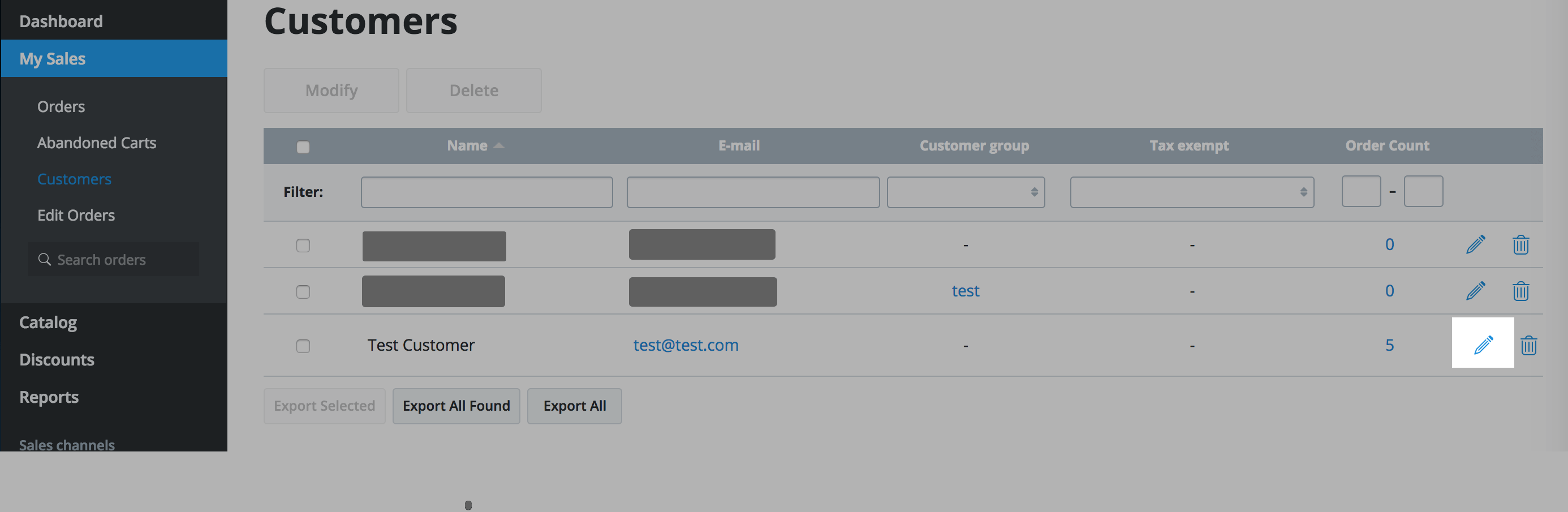

- From your store’s admin, go to My Sales → Customers.

- Find the customer on the list by name or email and click the pencil icon to edit the customer’s profile:

If a customer doesn’t have a profile in your store yet, they can sign up themselves or you can import their profile data.

- Enable Tax exempt and save the changes:

That’s it. Now the customer is marked as tax exempt and, after logging into their customer account in your store, they will pay no taxes when buying from you.

The tax exempt status may provide not only complete relief from taxes, but also reduced tax rates, or tax exempt for a certain category of goods. Currently, the store allows to set only a 0% tax rate for non-taxable customers that is automatically applied to all products in the store.

A customer marked as tax exempt still sees taxes at checkout

In order to get a 0% tax rate, non-taxable buyers have to sign in in your store before heading to checkout and placing an order. Otherwise, the standard taxation rules configured in the store will be applied.

Such customers should be advised to log in before purchase using the correct email. You as the store owner can check this email in your store’s admin, My Sales → Customers.

If you have many tax-exempt customers, consider providing them with the instructions (for example, in a FAQ page) on creating account and contacting you about tax-exempt purchases in your store.