US taxes

If you’re a US merchant, you’re most likely required to pay sales tax according to state and local laws. In this article, we will explain how to set up your store so that you are able to collect, report, and file sales tax properly.

Sales tax applicable to the sale of most products and some services in most states. The rates and rules notably differ from state to state, though. For example, California has the highest state-level sales tax rate at 7.5 percent. The lowest sales tax is in Colorado, which has a rate of 2.9 percent.

In order to know what taxes apply to your business, please use this helpful State Sales Tax Map (click your state on the map).

Set up automatic US tax rates

If you need to charge tax within the United States, then taxes might apply in your city, county, and state. To handle this complexity, you can use automatic tax settings.

When automatic tax rates are enabled:

- Your store automatically calculates tax rates depending on your state tax law, store, and customer location.

- Your store stays up to date on the tax law: once tax laws are changed in your state, county, or even city government, your store will “know” the new rules and apply them at checkout. No actions required on your side.

To enable automatic US sales tax:

- Add your company address in your store admin → Settings → General → Store profile.

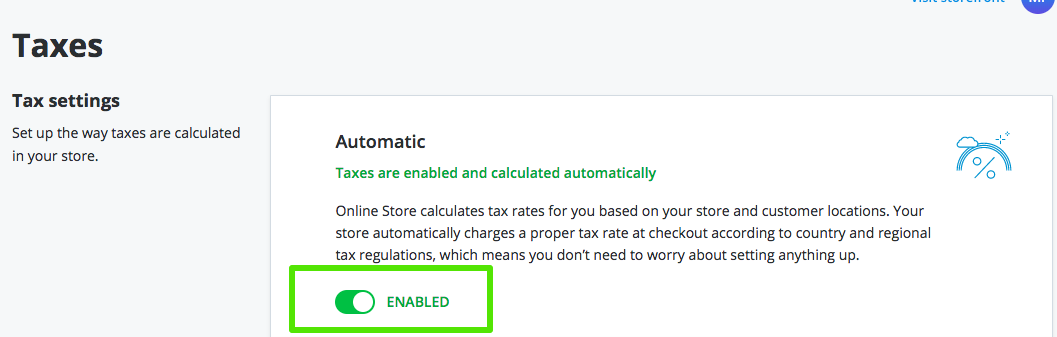

- Enable automatic tax calculations in your store admin → Settings → Taxes:

Once the automatic tax rates are enabled, your store will charge a precise tax rate depending on where you and your customers are located.

By default, the same standard tax rate of your store’s region applies to all the products. If some of your products are taxed differently (e.g., they are tax-exempt), you can change the tax rate for them.

If our automatic tax feature doesn’t cover your needs entirely (e.g., you want to charge taxes when selling to other countries), you can set up taxes manually. Find the Manual section in your store admin → Settings → Taxes and click Manage tax rates to be able to add rates manually. Please, refer to this instruction for manual setup to configure your store to calculate tax rates for different regions, zones, and countries.

Handling tax-exempt customers

If you don’t want to charge taxes on some of your customers, e.g. non-profit organizations or wholesalers, it also can be done easily. Just mark them as tax-exempt on the Customers page in your store admin. Please, refer to this article for more details: Tax-exempt customers.

Handling non-taxable items

If there are non-taxable products in your store, you can set up a zero tax for them regardless which tax setup you use in your store — automatic or manual. You can also set up reduced or other non-standard tax rates. Please, refer to this article for more details: Product-specific tax rates.